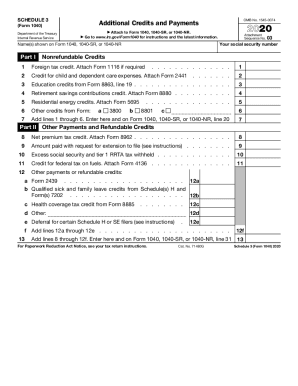

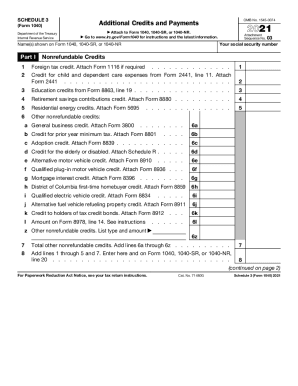

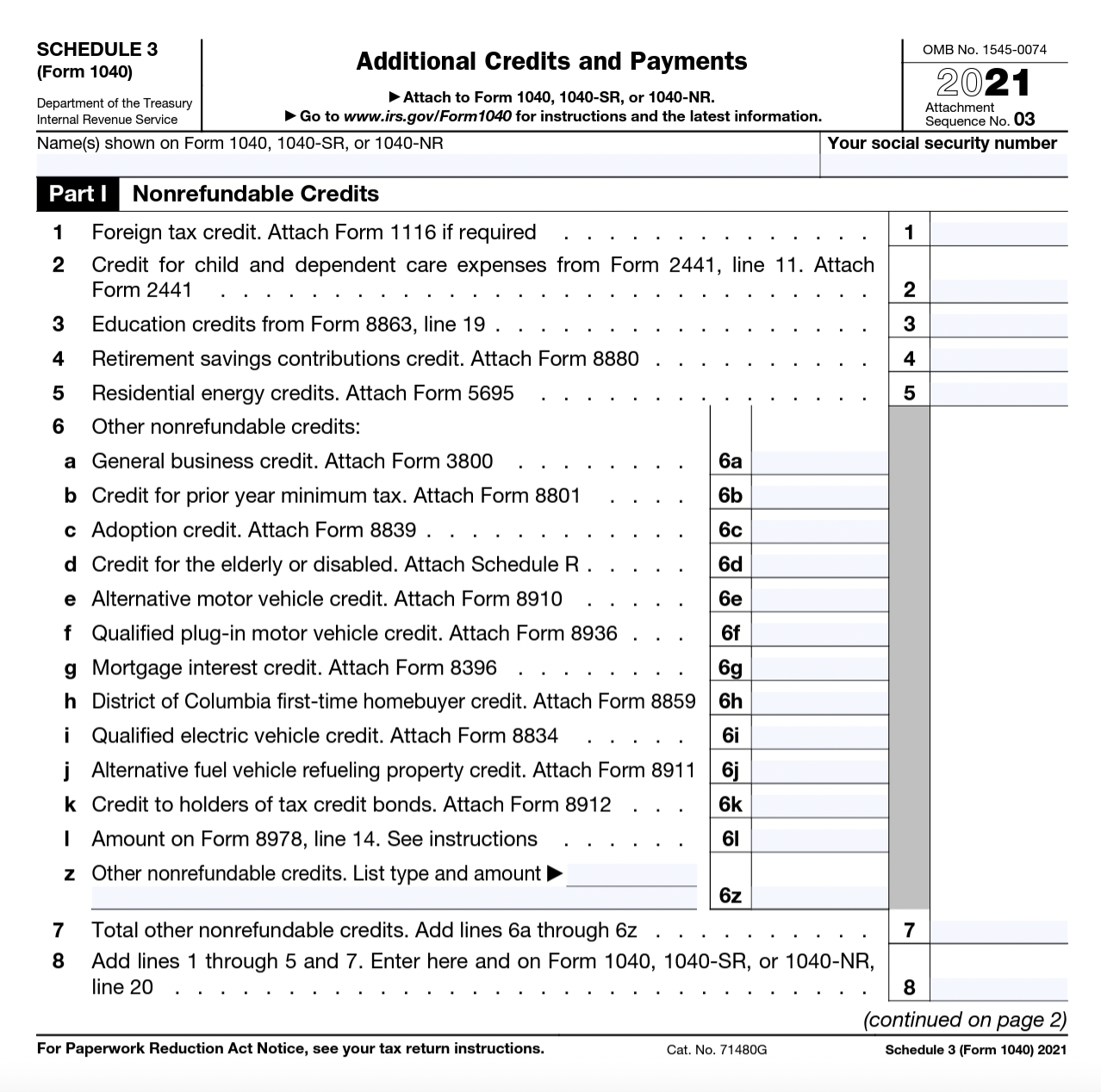

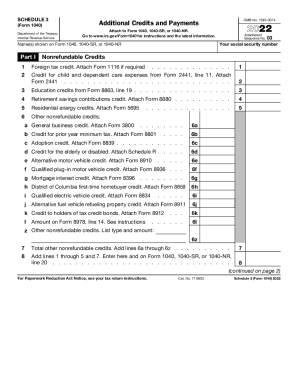

2024 Form 1040 Schedule 3 Schedule – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule 3 Schedule

Source : www.dochub.comSchedule 3 2020 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 3 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.comMost commonly requested tax forms | Tuition | ASU

IRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

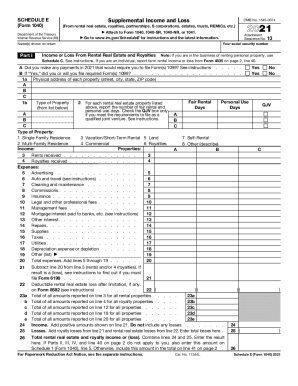

Source : www.irs.govIRS 1040 Schedule E 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com2024 Form 1040 Schedule 3 Schedule Schedule 3: Fill out & sign online | DocHub: The 1099 forms are sent to you by clients you work for. Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D Crypto Tax Myth #3 – You only owe taxes to the IRS if you receive a Form 1099-B. .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)